If you are a freelancer, you must know how to collect payments. It is one of the more crucial things you’ll need to determine when you first enter the world of freelancing. The right approach can reduce stress and costs while also saving a ton of time. Regardless of what type of freelancing you do, make sure your resume is relevant and reflects your current experience for future clients and customers. Turn to a resume editing service for a good resume. The incorrect payment channel could result in an unnecessary fee. It also increases the risk of not being paid for your work and lengthy delays before receiving your money. Each method has advantages and disadvantages depending on your geographical location and home currency. Having an excellent payment method for independent contractors can be difficult if you don’t know where to begin.

Selecting the Perfect Payment Method for Your Freelancing: Benefits of Variation

Earning money has become more accessible thanks to advances in digital technology. People can now do online freelancing and make money for their services. However, some people need help selecting the appropriate payment method. When selecting a payment method, ensure that the service charge they charge for each transaction is within your budget. The easiest payment methods are those that are convenient for your client. Thus, this will assist you in receiving payment on time and without any issues.

Having multiple payment options can help freelancers grow. It allows their clients to pay in the way that they prefer. Some clients, for example, may choose to pay with a credit card or PayPal, while others may have different options. Multiple options can provide the freelancer and their client peace of mind. There are additional advantages to having more than one option. The main advantage is that multiple payment gateways are an excellent way to grow your business. Different methods frequently provide higher conversion rates to freelancers.

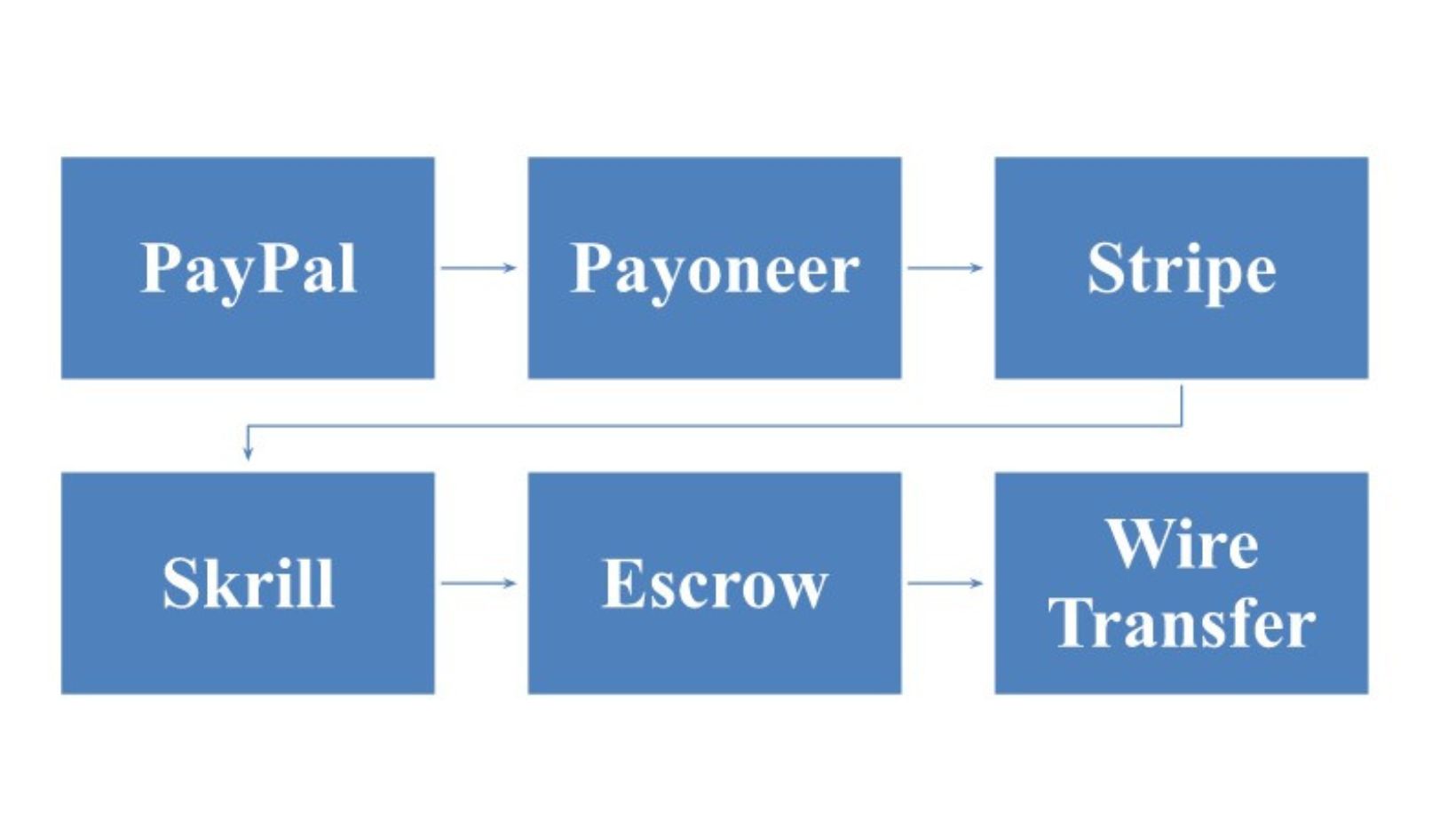

To start a new business, you must sort out many things, from payment methods to payroll tools. We’ve compiled a list of six freelance payment methods to assist you with your freelance payments.

PayPal

PayPal was founded in 1998. It is one of the oldest and most well-known methods for individuals to send and receive money online. The company has a specialty in electronic money transfers, which is the primary payment method. Many websites, organizations, freelancers, and online stores use PayPal as their payment option. They’re even the most popular way to withdraw money from freelance platforms, Fiverr and Freelancer.com. PayPal is currently the largest platform of this type, but it is only suitable for some.

| Pros | Cons |

|

|

Payoneer

Payoneer is a virtual online bank that enables bloggers and independent contractors to send and receive money from anywhere. It allows online marketers to open new accounts with limited credit with just one click. The company’s service is especially beneficial to people who have been demobilized or are unemployed and living in poverty. To obtain basic financial necessities, anyone can use the Payoneer service.

It provides a secure and straightforward method for receiving and paying bills via email, text message, or even online with a credit card. Thanks to the integrated mobile app, we can receive monthly payments via the internet. You no longer need to carry physical banknotes to conduct any transaction because your finances are managed by a system that operates 24 hours a day, seven days a week.

| Pros | Cons |

|

|

Stripe

Stripe has got an improved payment process for both small and large businesses. Stripe Payments allows freelancers and business owners to accept payments via email, web hosts, or mobile apps. Both large and small businesses can use it. Stripe also provides a web service that allows developers to charge a fee to package their applications with Stripe processing capabilities. It operates in over 70 countries and has over 500,000 business clients worldwide. Stripe provides fee-for-service payment processing services to early-stage start-ups and existing businesses.

| Pros | Cons |

|

|

Skrill

Users of Skrill can send money across borders. One thing you will notice about the Skrill payment platform is its low transaction fees. These are one-time fees that vary depending on the location of the transaction. There are also some restrictions on this payment platform. Skrill typically takes 2 to 5 business days to complete a transfer. However, it depends on several factors. For example, the transaction may take longer to complete on the weekend. Invoice transactions are also supported, and users can keep track of completed transactions. The exchange rate for Skrill is 3.99%. In addition, they will deduct 9% of the funds received. However, the sum isn’t more than 20 Euros.

| Pros | Cons |

|

|

Escrow

Another type of online payment platform is Escrow. Payments are simple here because clients can hold funds until the business transaction is completed. After that, the clients release the funds to the freelancer.

After ten working days, transaction orders and checks are completed. Escrow invoices are typically delivered in the form of bank statements. Charges are usually calculated based on the amount being transferred. Use the Escrow fee calculator to confirm the amount to be charged.

| Pros | Cons |

|

|

Wire Transfer

This payment method allows you to receive funds electronically. The sender provides the transfer instructions here. The amount, recipient’s name, account number, and bank are typically included in these instructions. Most Wire Transfer transactions are completed in a matter of minutes. However, due to unforeseen complications and factors, it may only last three days at most. The banks involved are a simple example of such elements. Thus, this can affect how long it takes to complete the transaction. The fees here typically range from $0 to $50.

| Pros | Cons |

|

|

Conclusion

You must become familiar with payment options if you are a freelancer or find a freelance job. Before switching to another, you must concentrate on one payment method for a while. This is because each payment method has its advantages and disadvantages. Numerous businesses rely on freelancers as their core resource, and providing them with various payment options can boost their output. Offering multiple payment options to customers can help you retain current customers, attract new ones, and improve your cash flow.